Table of Content

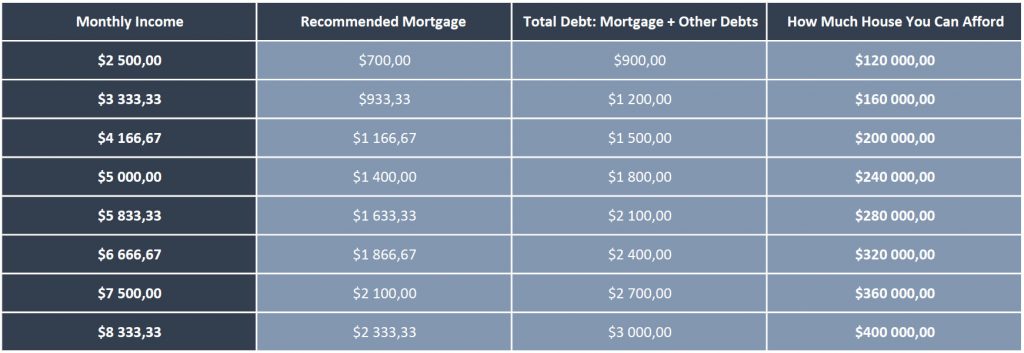

It states that a household should spend no more than 28% of its gross monthly income on the front-end debt and no more than 36% of its gross monthly income on the back-end debt. The 28/36 Rule is a qualification requirement for conforming conventional loans. When owning a home, you pay annual property taxes based on the assessed value of the property or purchase price of the home, which can affect your affordability.

Use the affordability calculator to see how your down payment affects your home affordability estimate and your monthly mortgage payment. The amount you'll need to close your loan includes your down payment, closing costs, and prepaid escrow amounts for property taxes and insurance. The part of your monthly payment that goes toward property taxes charged by your local government. We typically collect a portion of these taxes in every mortgage payment and hold the funds in an escrow account for tax payments made on your behalf as they become due. It is highly recommended that you speak with a lender or loan professional of your choice about your mortgage loan needs and to help determine your home affordability. Realtor.com provides information and advertising services – learn more.

USDA loan (government loan)

Note that, in order to qualify for an FHA loan, the borrower must intend to use the house as a primary residence and live in it within two months after closing. An optimal DTI is 36% or below, including possible housing costs, but excluding current rent payments, if any. If your monthly income is, for example, $5,000, then you shouldn’t owe more than $1,800 per month. With the exception of those who qualify for VA loan or a 0% down payment mortgage program, most buyers will have to give a down payment on their potential home.

The mortgage you qualify for varies according to your present circumstances. The two main factors that are typically considered in determining how much mortgage you qualify for are your monthly income and your monthly expenses. The Maximum Mortgage Calculator uses your current financial situation to calculate the maximum monthly mortgage payment that you can afford. Total debt should not exceed 36% of your total pre-tax income. This does not include other monthly expenses such as groceries, gas or your current rent payments. The monthly amount of your mortgage payment depends on loan term and interest rate.

How Will My Debt-to-Income Ratio Affect Affordability?

Refinance calculator Decide if mortgage refinancing is right for you.Loading... Seller's marketplace Explore your selling options and get instant offers.Loading... And, if you’re ready to buy, visit our best mortgage lenders page to find the right lender for you.

If you have a co-borrower who will contribute to the mortgage, combine the total of both incomes to get your annual income. We do not offer or have any affiliation with loan modification, foreclosure prevention, payday loan, or short term loan services. Neither FHA.com nor its advertisers charge a fee or require anything other than a submission of qualifying information for comparison shopping ads. We encourage users to contact their lawyers, credit counselors, lenders, and housing counselors. Ideally, it is better to get started with your mortgage calculations before you even find a home. As long as you know how much you can make as a down payment, your monthly salary and expenses, and your loan term, you can go ahead to begin punching those numbers.

How Much House Can I Afford With an FHA Loan?

Private Mortgage Insurance is calculated based on your credit score and amount of down payment. If your loan amount is greater than 80% of the home purchase price, lenders require insurance on their investment. This is a monthly cost that increases your mortgage payment. Most home loans require at least 3% of the price of the home as a down payment. Some loans, like VA loans and some USDA loans allow zero down. Although it's a myth that a 20% down payment is required to obtain a loan, keep in mind that the higher your down payment, the lower your monthly payment.

You could save a bigger down payment to lower your monthly mortgage until it’s no more than 25% of your take-home pay. Or look for a smaller starter home in a more affordable neighborhood. Now let’s take what we’ve learned and put it into an example. First, you’ll need to do the hard work of saving up $80,000 in cash as a 20% down payment.

FHA loans have looser requirements around credit scores and allow for low down payments. An FHA loan will come with mandatory mortgage insurance for the life of the loan. That means your mortgage payment should be a maximum of $1,120 (28 percent of $4,000), and your other debts should add up to no more than $1,440 each month (36 percent of $4,000). You’ll need to determine a budget that allows you to pay for essentials like food and transportation, wants like entertainment and dining out, and savings goals like retirement. Please visit our VA Mortgage Calculator to get more in-depth information regarding VA loans, or to calculate estimated monthly payments on VA mortgages.

Get pre-qualified by a lender to confirm your affordability. VA mortgage calculatorUse our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families. The most recognized 3.5% down payment mortgage in the country. Calculate your monthly debt and compare it to your gross income to get an idea of your DTI. If you want to learn more about refinancing, check out our best mortgage refinance lenders page for more information. And, to find out what your future mortgage rate would be after refinancing, use our mortgage refinance calculator.

Plus, you may have trouble maintaining your other financial obligations, including building up your emergency fund and saving for retirement. This will be used to determine your taxes as well as how much you can afford in monthly payments. The first step to budgeting for a house is to know how much down payment you need.

Use our affordability calculator to dig deeper into income, debts and payments. Modify the interest rate to evaluate the impact of seemingly minor rate changes. Knowing that rates can change daily, consider the impact of waiting to improve your credit score in exchange for possibly qualifying for a lower interest rate. Click the "Schedule" for an interactive graph showing the estimated timeframe of paying off your interest, similar to our amortization calculator. Adjust your down payment size to see how much it affects your monthly payment. For instance, would it be better to have more in savings after purchasing the home?

No comments:

Post a Comment