Table of Content

- Consider applying to federal loans

- Save a bigger down payment to make your home more affordable.

- Mortgage affordability calculator

- Tips When You Can’t Afford the House You Want

- Conventional loan (conforming loan)

- What are the most important factors that help determine how much house I can afford?

- Monthly mortgage payment

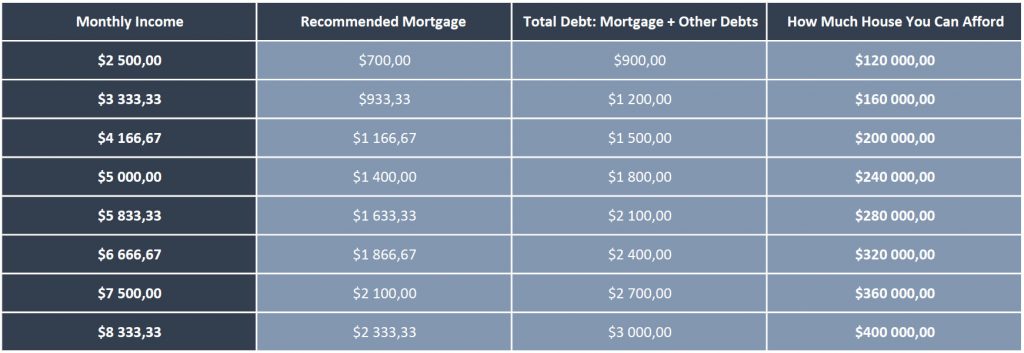

- How many times my income can I afford in a house?

The scoring formula takes into account the type of card being reviewed and the card's rates, fees, rewards and other features. This is the amount that you pay each month that goes toward paying down the principal of the loan and the cost of borrowing . Your debt-to-income ratio would be 36%, meaning 36% of your pretax income would go toward mortgage and other debts.

If your income isn’t consistent throughout the year, either due to self-employment or seasonal work, your lender will typically want an explanation of the variations in the income stream. If you’re selling your current home before buying a new one, the value of your home will ultimately determine your down payment. Be modest in your appraisal, or get the help of an experienced real-estate agent. Beyond the amount of debt and income you have, there are several factors that will affect how much house you can afford — primarily your down payment and credit score. At closing, escrow will ensure you've paid your share of the property's taxes up to the date of closing.

Consider applying to federal loans

This includes your monthly principal and mortgage interest rate, home insurance, annual property taxes, and private mortgage insurance payments . The calculator also allows the user to select from debt-to-income ratios between 10% to 50% in increments of 5%. If coupled with down payments less than 20%, 0.5% of PMI insurance will automatically be added to monthly housing costs because they are assumed to be calculations for conventional loans.

But if you can swing a balance transfer it might be able to help you fast-track your debt payment and get you to the debt-to-income ratio you need to qualify for a home purchase. The bigger the down payment you can bring to the table, the smaller the loan you will have to pay interest on. In the long run, the largest portion of the price you pay for a house is typically the interest on the loan. If you are spending 40% or more of your pre-tax income on pre-existing obligations, a relatively minor shift in your income or expenses could wreak havoc on your budget. In order to avoid the scenario of buying a house you truly can’t afford, you’ll need to figure out a housing budget that makes sense for you. Because when life happens, an unexpected expense or a job loss could crush someone financially if they’realsotrying to get out of debtandpay a mortgage.

Save a bigger down payment to make your home more affordable.

But if saving up to pay cash isn’t reasonable for your timeline, you’ll probably get a mortgage. Just save up a down payment that’s 20% or more of the home price. If you’re afirst-timehome buyer, a down payment of 5–10% is okay—but you’llhave to pay that peskyprivate mortgage insurance.

Conventional loans typically require a minimum down payment of 5 percent — however, it could be as little as 3 percent if you have a low DTI ratio, high credit score and meet other requirements. Purchasing a home is a decision that will impact your financial situation for the next 15 to 30 years. It’s important to calculate your monthly income and expenses carefully to avoid winding up with a mortgage loan you can’t pay in the long run.

Mortgage affordability calculator

Generally, a longer-term loan will have lower monthly payments, but at a higher interest rate, so you’ll end up paying more money over the life of the loan. You can build up your credit or save for a larger down payment to help qualify for a lower interest rate. A lender can also help determine your mortgage affordability, and present the best loan term and interest rate for your home.

Our affordability calculator will suggest a DTI of 36% by default. You can get an estimate of your debt-to-income ratio using our DTI Calculator. Our maximum mortgage calculator helps you calculate the maximum monthly mortgage payment and total mortgage amount you can afford.

Tips When You Can’t Afford the House You Want

If you go with this plan it’s important to make sure your mortgage terms don’t include a penalty for paying off the loan early. This is known as a pre-payment penalty and lenders are required to disclose it. Most banks don’t like to make loans to borrowers with higher than a 43% debt-to-income ratio.

If you make a down payment of less than 20 percent on a conventional loan, you’ll need to pay for private mortgage insurance, or PMI. The general rule of thumb with mortgages is that you can borrow a mortgage that costs up to two and a half (2.5) times your annual gross income. The total will vary depending on what your lender charges, whether you’ll pay real estate transfer taxes and if the seller agrees to cover a portion of the fees. As you’re budgeting for a home purchase, it’s wise to plan for between 2 percent and 5 percent of the home’s purchase price. So, if you’re buying a $400,000 home, your closing costs might range between $8,000 and $20,000. Some lenders might give you the option to roll those costs into the loan to avoid paying for them out-of-pocket.

You’ll also need to factor in how mortgage insurance premiums — required on all FHA loans — will impact your payments. Lenders tend to give the lowest rates to borrowers with the highest credit scores, lowest debt and substantial down payments. Use Zillow's affordability calculator to estimate a comfortable mortgage amount based on your current budget. Enter details about your income, down payment and monthly debts to determine how much to spend on a house. Generally, most new homebuyers will consider taking out a conventional mortgage loan. Monthly DebtsYour monthly debts are car payments, student loans, and other recurring personal expenses you make monthly payments on.

If you’re sitting on the money you need for a 20 percent down payment, your income needs look a lot different. For example, if you can put down $80,000 and lock in a 4.75 percent interest rate on a 30-year mortgage, you only need to earn $78,000 per year. Your interest rate and your plans for a down payment play an important role. Where you live plays a major role in what you can spend on a house. For example, you’d be able to buy a much bigger piece of property in St. Louis than you could for the same price in San Francisco.

A lower interest rate means lower monthly mortgage payments. Estimate your monthly payments, closing costs, APR and mortgage interest rate today. This is your maximum monthly principal and interest payment.

No comments:

Post a Comment