Table of Content

With Online Typing Jobs Without Investment, you can earn money by typing text. CYBER EXPO typing has the only email and live chat support. If you need phone support you have either the top earner or have to choose other paid registration company. Up to 2 hours free YouTube Video Training for new online data entry work member.

Transcriptionists listen to an audio recording and type out the words into an online document. This could be for a number of different audio files including speaking engagements, seminars, speeches, videos. Then you type the text into a word processor like Word, Mariner, or Google Docs.

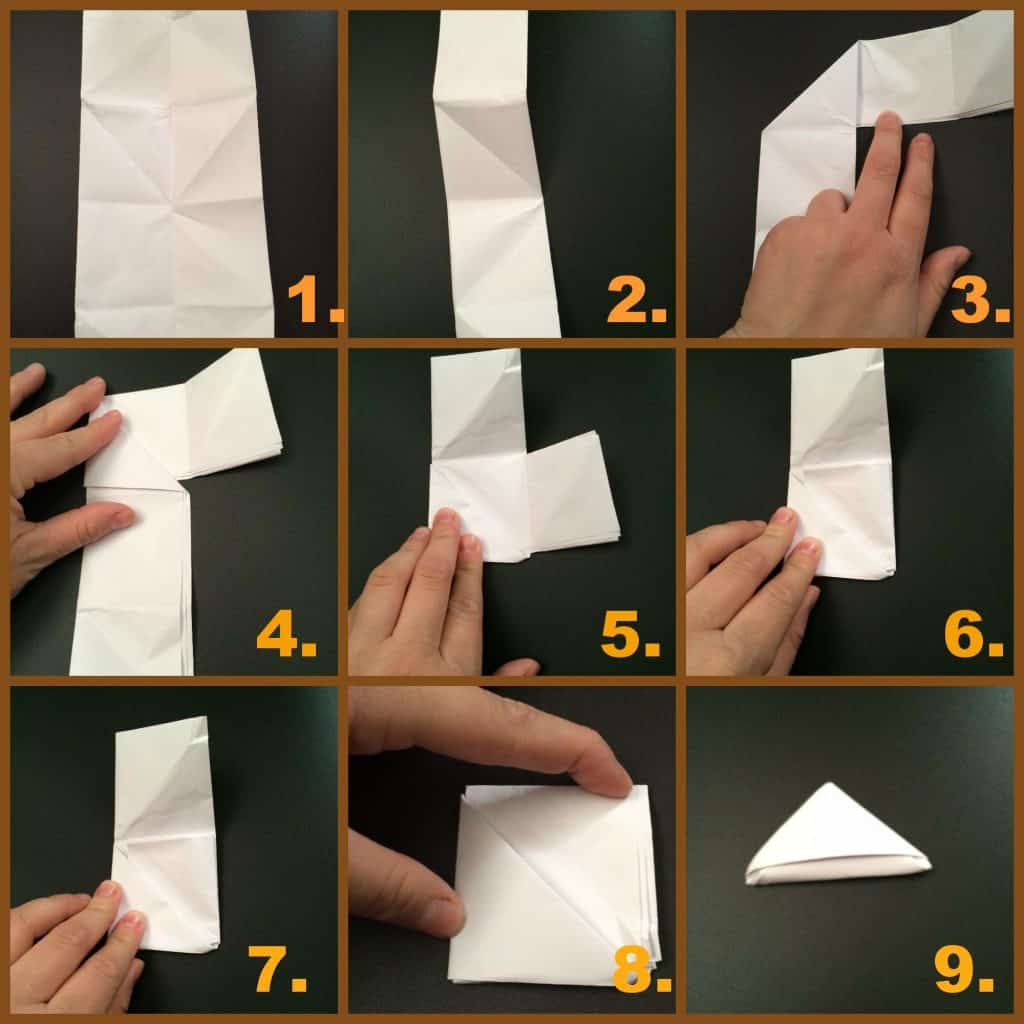

How to get registered? with this simple 5 steps:

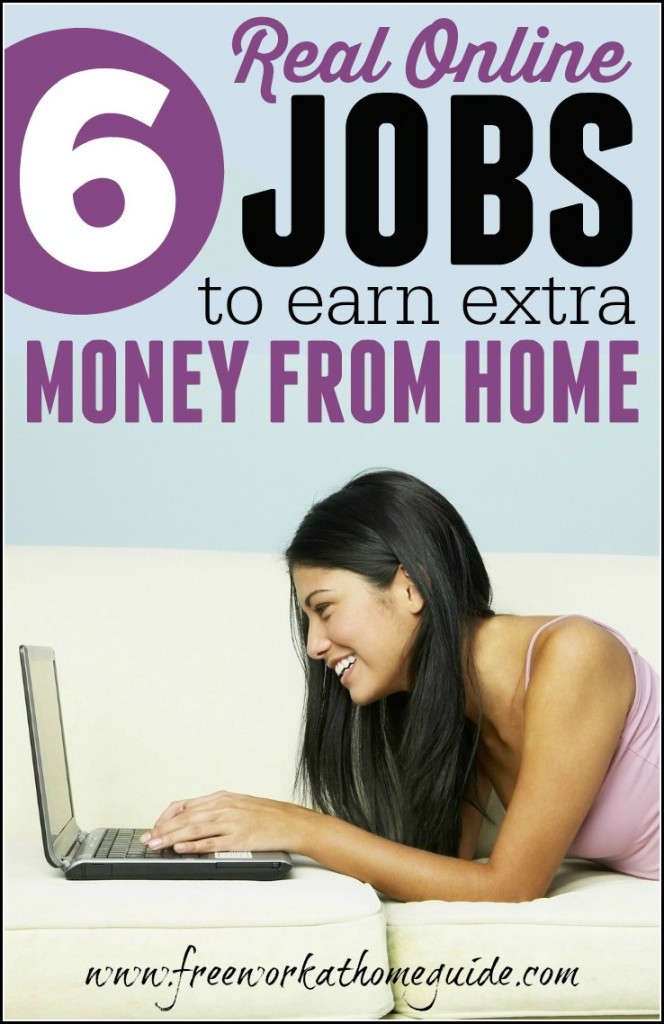

You don’t need any special education for most projects. If you have a computer and high-speed internet you have everything you need to make money by typing. It’s a great option for people who are good typists and love to work independently. There are also specialized websites that offer legitimate opportunities for each kind of work.

Contact me if there’s any typing or data entry job . I will complete assigned work in time and accuracy. Good evening, I am interested please send me details of jobs as early as possible. There are so many daily payment typing work from home available in India.

Wise Jobs

Work full-time, part-time, or for extra money on the side. Legal transcription jobs are performed by certified court reporters. Type transcribe legal proceedings such as courtroom proceedings. There is a huge requirement in this industry and today, more and more people are looking forward to such an earning method. Besides, if you have a good typing speed, that will be an advantage for you to work more and earn more.

Sir I am interested for job plz send the details to my email id. Hi I am interested to do this work, but I don’t pay any registration amount. Sir I am interested for job plz send the details to my emailid. There are tons of typing work projects available at freelancing platforms. I am interested in online typing please provide me details about this job and please provide me contact no of concern person asap.

Step-3: Start Earning Money by Typing Online – (with Daily Payment)

It will show you six ways that you can be more productive in order to make more money. If you're looking for a legitimate way to earn cash while reading the news, these are the best options. Some of the paid search programs are offered by Google Opinions Rewards and Screenwise Trends.

Rev is a company that specializes in converting speech to text. This is a great place to use your typing skills by transcribing audio files like educational videos into written text. You can choose the projects you’re interested in and complete them by a set deadline. Payment is also issued weekly via PayPal and to work at Rev, applicants need to be at least 18 years old. Many websites let you make money online by doing freelance writing work. These sites give hundreds of writing projects every month without any investment.

Legit Online Writing Jobs in Kenya

All you need is a computer with an internet connection and a good typing speed. DionData Solutions is an online transcription service that pays $0.50 per audio minute. There are many other sites that pay $0.10 per audio minute, but DionData is the only one that pays $0.50 per audio minute. In addition to this rate, they also offer a commission based on the length of the audio recording. The site is similar to CastingWords, but requires that you have a specific skill set in order to qualify to work for them.

But what makes it out of the box is it allows you to work with them as long as you live in a country where PayPal payments are available. In some cases, a transcription test is taken before proceeding. You get to receive your earnings on time, there is no delay in the process. As you submit the work within the deadline you get paid for the same. When you have an extra source of income, you can use that as an investment in multiple ways.

Start now, with no registration fees or deposit, and your work will start in 5 minutes. Because of the increasing ease of access to the Internet, nowadays we have nearly endless online jobs opportunities. And the most famous are online typing jobs and online data entry jobs with no investment. You can easily start the typing job from home in India and earn daily payment. A job seeker can sign up here and read articles on typing jobs during their free time.

Some people do it by working from home while others work from a remote office. The most important thing is to find the right business model that suits you and your lifestyle. If you have time to spare, then this is an excellent way to bring in some extra cash every month. All you need is a laptop or computer with internet access and a program like Microsoft Word, Google Docs or Open Office. Another paid news reader job is the Inbox Dollar program. With this program, you can earn up to $500 per month.

CyberDictate is popularized among those who desire to gain specialization in the field of typing for money. Only legal transcription positions are offered in the course of work. They are quite strict concerning their requirements.